FL NCCER Form 200 2014-2024 free printable template

Show details

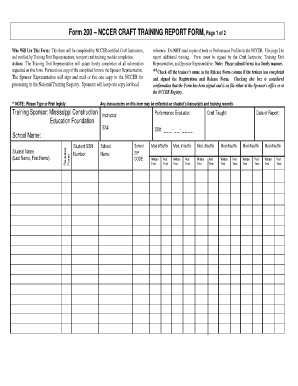

Name Release Form First Name Last Name Employer Zip Code main or home office Form 200 continued I attest that all of the information reported on this form is true. Form 200 NCCER Training Report Form - Instructions If module requires a Performance Test the Instructor must indicate Pass P or the test pass date in the column provided in order for trainee to receive credit. 622. 3720 ext. 6914/6916/6917/6918 Form 200 - Page 1 of 3 Effective 07/14 Who Will Use This Form This form will be...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form 200 2014-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 200 2014-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 200 online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nccer 200 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

FL NCCER Form 200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 200 2014-2024

How to fill out form 200:

01

Begin by obtaining a copy of form 200 from the relevant authority or website.

02

Carefully read the instructions provided with the form to understand the requirements and any specific guidelines.

03

Start by entering your personal information, such as your name, address, contact details, and any other required identification information.

04

Proceed to provide the requested information in each section of the form accurately and legibly. Pay attention to any specific details or formatting requirements mentioned in the instructions.

05

If any supporting documents are required, ensure they are attached or included as per the instructions provided.

06

Review the completed form thoroughly to ensure all the information is accurate and complete.

07

Sign and date the form in the designated spaces.

08

Make a copy of the filled-out form for your records before submitting it as required.

Who needs form 200:

01

Individuals or businesses involved in a specific process or transaction that requires submission of form 200.

02

The specific purpose or requirement for form 200 can vary depending on the context, such as tax reporting, licensing, permits, or regulatory compliance.

03

To determine if you need to fill out form 200, refer to the relevant authority or organization that governs the process or transaction for which the form is required. Follow their guidelines or reach out to them directly for clarification if needed.

Fill 200 form : Try Risk Free

People Also Ask about form 200

What is the Virginia state tax form called?

What is a Virginia litter tax?

What is the Virginia litter tax return form?

What is a VA 5 tax form?

Who must file a Virginia non resident tax return?

Who has to pay litter tax in VA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 200?

Form 200 is not a specific form that can be identified without further context. There are numerous types of forms used for various purposes in different contexts, such as tax forms, government forms, business forms, and legal forms. To determine the exact nature and purpose of form 200, more specific information is needed.

Who is required to file form 200?

The information provided is not clear. There is no specific "Form 200" mentioned in the Internal Revenue Service (IRS) forms. Please provide more context or clarify the specific form for a more accurate answer.

How to fill out form 200?

Form 200 is a generic term and can refer to different types of forms depending on the context. Without more specific information about the purpose of the form, it is difficult to provide detailed instructions on how to fill it out. However, here are some general steps that can help you fill out most forms:

1. Read the instructions: Start by carefully reading the instructions, if available. The instructions will guide you on how to correctly complete the form and provide any specific requirements.

2. Provide personal information: Fill in your personal information accurately, such as your name, address, Social Security number, or any other required identifiers.

3. Identify the purpose: Determine the purpose of the form and fill in the relevant sections accordingly. For example, if it is a tax form, you may need to enter income details, deductions, and exemptions.

4. Use clear and concise language: Write clearly and concisely when providing any explanations or descriptions. Ensure that your responses are complete and accurate.

5. Double-check for errors: Before submitting the form, carefully review all the information you entered to ensure there are no mistakes or omissions. Small errors can lead to delays or rejection of the form.

6. Include necessary attachments: If the form requires any supporting documents or attachments, make sure to include them as instructed.

7. Sign and date: Finally, sign and date the form in the appropriate places if required.

It is essential to note that the specific steps for filling out Form 200 may vary depending on the purpose and requirements of the form. Therefore, it is always advisable to closely follow the provided instructions or seek guidance from a professional if needed.

What is the purpose of form 200?

Form 200 does not specifically refer to a standardized form, so it is difficult to determine its specific purpose without additional context or information. In general, forms are commonly used to collect or provide information for various purposes such as registration, documentation, reporting, or legal compliance.

What information must be reported on form 200?

Form 200 is typically associated with tax filing purposes for nonprofit organizations. The specific information required on Form 200 may vary depending on the jurisdiction and the specific reporting requirements in place. However, some common information that may be reported on Form 200 includes:

1. Basic information: Name, address, and contact details of the nonprofit organization.

2. Purpose and activities: A description of the organization's mission, primary activities, and any significant changes in programs or operations during the reporting period.

3. Financial information: Details of the organization's revenue and expenses, including an itemized breakdown of various income sources (such as donations, grants, and program fees) and expenses (such as salaries, overhead costs, and program-related expenses).

4. Governance and management: Information on the organization's board of directors or trustees, key personnel, and any significant governance or management changes during the reporting period.

5. Compliance information: A declaration of compliance with relevant laws, regulations, and reporting requirements, such as tax-exempt status requirements or nonprofit governance regulations.

6. Other attachments: Depending on the specific reporting requirements, Form 200 may require additional supporting documents, such as audited financial statements, copies of annual reports, or disclosure of related party transactions.

It is important to consult with the relevant tax authority or accounting professional for the specific reporting requirements and guidance regarding Form 200 in a particular jurisdiction.

What is the penalty for the late filing of form 200?

The penalty for late filing of Form 200 would depend on the specific regulations and policies of the jurisdiction or agency that requires the form. Without knowing the specific context, it is not possible to determine the precise penalty. In general, late filing penalties can range from a fixed amount per day or per month of delay to a percentage of the amount due or owed as reported on the form. It is recommended to consult the relevant authority or agency that requires Form 200 to find accurate information regarding the applicable penalty for late filing.

How can I send form 200 for eSignature?

When you're ready to share your nccer 200 form, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute how to form 200 online?

pdfFiller has made filling out and eSigning form training report easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make changes in nccer form 200?

With pdfFiller, it's easy to make changes. Open your form 200 pdf in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your form 200 2014-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Form 200 is not the form you're looking for?Search for another form here.

Keywords relevant to mod nccer form

Related to nccer 200 instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.